“They showed me step by step what was happening. No false promises—just real results.”

What clients say

“Transparent, timely, and professional. I always knew the next step.”

“Real progress in the first 60 days.”

“Clear plan, consistent follow-through.”

“Very communicative and respectful—trusted them immediately.”

“The portal made everything simple and organized.”

“They fought hard for my case and kept me updated.”

“Professional team, clear expectations, solid results.”

“No hype—just a proven process that works.”

“They explained every letter and response.”

“Felt supported the whole time—highly recommend.”

“Great communication and measurable improvement.”

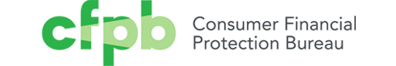

A clear look at your credit, with reports from all three bureaus

Transparency is key. You deserve to know exactly what’s happening at every step—and we make sure you always do. Learn more →

Getting started is simple—just a few steps to better credit

We’ve made the process straightforward so you know exactly what to expect.

Step 1: Click “Get Started”

Tap the button and complete a quick form so we can pair you with the right specialist for your goals.

Read More →

Step 2: Connect With Your Specialist

We review your situation and craft a tailored plan to strengthen your credit.

Read More →

Step 3: Secure Your Credit Report

After payment and a quick consultation, you’ll receive a secure link so we can pull all three bureau reports safely.

Read More →

Step 4: We Begin the Process

We go to work immediately—sending targeted dispute letters and following through to drive measurable progress.

Read More →Explore Guides & Tools

Credit Builders

Build positive history the right way with vetted options that fit your profile.

Read more →

Credit Monitoring

Stay ahead with consistent monitoring and real-time alerts from trusted providers.

Read more →

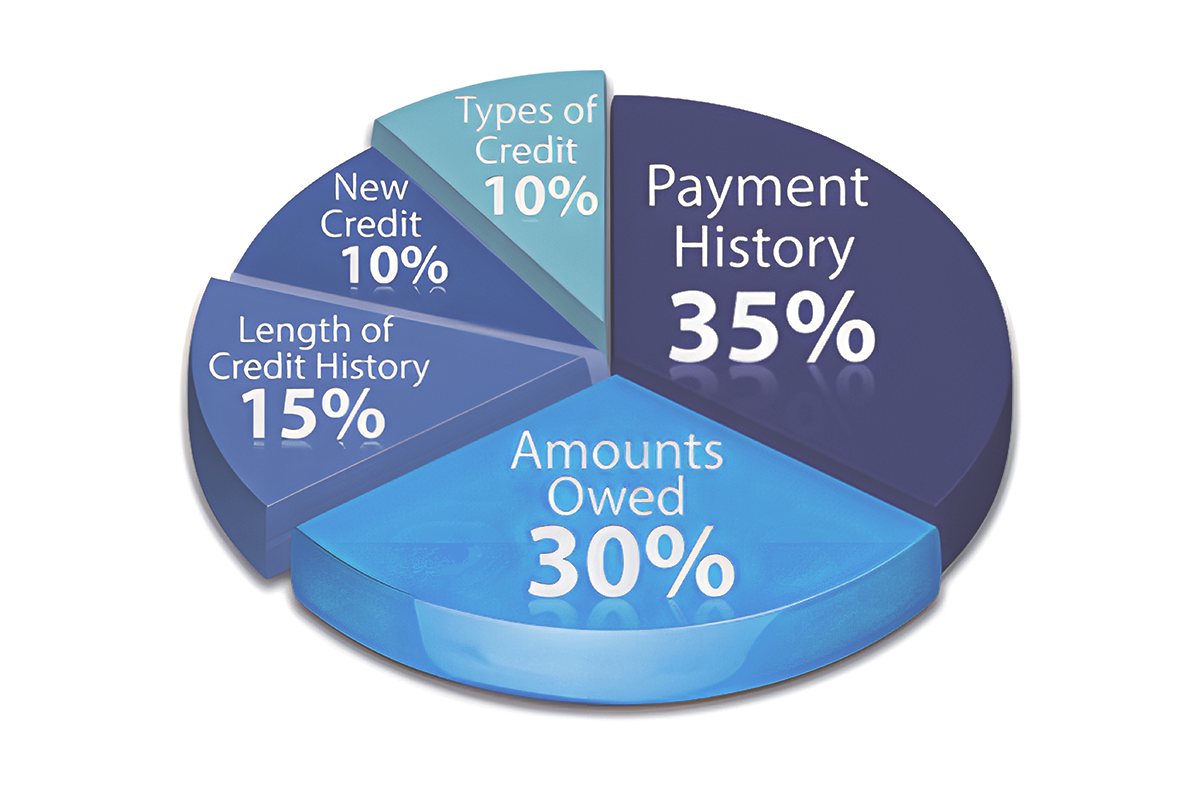

Credit Factors

Understand what truly drives your score—payment history, utilization, and more.

Read more →

What Not to Do

Avoid the most common mistakes that can undo months of progress.

Read more →

Is Meta Fiscal Right for You?

We’re selective for a reason—see if our approach matches your goals and timeline.

Read more →Visit or Contact Us

Address245 Riverside Avenue, Unit 100, Jacksonville, FL 32202

HoursMon–Fri, 9:00 AM–5:00 PM (ET)

Phone(904) 849-6232

Email[email protected]

Frequently Asked Questions

Major changes commonly post in ~30–120 days as bureaus and creditors process mail and updates. We work in rounds and communicate clearly along the way.

Yes—maintain an active Credit Hero Score account during service. This gives us daily alerts and three-bureau access so we can verify changes quickly and act on new items in real time.

Late payments, collections, charge-offs, repossessions, some public records and more—when they are inaccurate, outdated, or unverifiable.

Yes—upload requested documents promptly, keep Credit Hero Score active for monitoring, and avoid opening new risky accounts without checking with us first.

We post updates in your portal and send notifications. You’ll also see bureau alerts via your monitoring provider.

No one can guarantee specific outcomes or dates. Our promise is a careful, compliant process that focuses on accuracy, consistency, and measurable progress.

Payment history and utilization have the greatest impact, followed by age, mix, and new credit. We coach habits to improve these over time.

We recommend pausing applications. New accounts or hard pulls can offset progress—ask your specialist before applying.

If a removed item reappears during your active window, we’ll review and re-address it. After service ends, we can engage again as needed.

We’re a great fit for clients who engage with the process, maintain monitoring, and prioritize long-term accuracy over shortcuts.